By Gary Symons

TLL Editor in Chief

Parents are putting their kids’ need for toys ahead of other budget items this holiday season.

That’s the finding of a large survey of 1,000 U.S. parents, conducted by Wakefield Research, on behalf of The Toy Association.

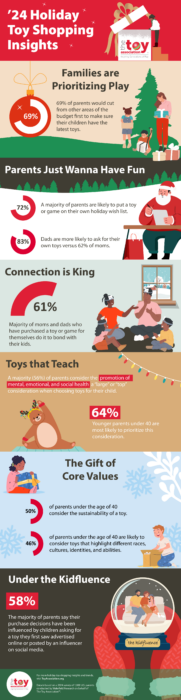

The survey found that while families are generally keeping a tighter eye on their holiday budgets due to inflation, 69% of parents says they would cut corners on other areas of their budget in order to ensure their kids get the toys they want.

The Toy Association says dads appear to be the weak link in the chain here, with 73% saying they would reduce spending elsewhere. Perhaps with a sharper eye on the household budget, only 65% of moms said they would cut corners on other budget items.

The Toy Association says dads appear to be the weak link in the chain here, with 73% saying they would reduce spending elsewhere. Perhaps with a sharper eye on the household budget, only 65% of moms said they would cut corners on other budget items.

As well, the survey shows the powerful ‘Kidult’ trend is continuing this holiday season, as a large, 72% majority of parents said they’ll be putting a toy or game on their own holiday wish list.

And moms, if you thought your male partner in parenthood was a bit childish, the data bears that out. Dads are much more likely to ask for their own toys, with 83% expecting something fun under the tree, as opposed to 62% of moms.

That said, 61% of parents buying toys or games for themselves said they do so to better bond with their kids through play.

All of this is good news for the toy industry, which had slumped in 2023, with U.S. sales revenue sagging by -8% before stabilizing in early 2024. Global sales also fell, although not by as much, declining by -2% in 2023.

“Though inflation has slowed, consumers remain cautious with spending,” said Adrienne Appell, executive vice president of marketing communications at The Toy Association. “Our survey shows that parents are still prioritizing purchases that spark joy, and nothing sparks joy for both kids and, now more than ever, adults, quite like toys.”

If the focus on toys could seem frivolous given the budget challenges posed by inflation over the past two years, Appell says the reality is parents see toy purchases as an investment in their children’s education and mental health. In fact, 56% of parents consider the promotion of mental, emotional, and social health a “large” or “top” consideration when choosing toys for their child. Younger parents under 40 are most likely to prioritize this at 64%.

“The wonderful thing about giving toys to anyone at any age is that they are much more than ‘just a gift’,” Appel says. “Toys teach, help regulate big emotions, encourage multi-generational play … and they are always infused with a bit of magic.”

The Wakefield survey also discovered some factors important for toy manufacturers and retailers. These include a growing preference for sustainable toys, as well toys that reflect or highlight minority races, cultures, identities and abilities. A good example of this would be the popularity of Barbie’s line of dolls, that have included people of different races and abilities, such as handicapped people who use a wheelchair, and even the first deaf Barbie character this year, not to mention characters of all races.

Half of all parents under the age of 40 said they consider the sustainability of a toy (i.e., how the toy was made or can be disposed of, and/or if the toy is durable and can be passed down) before purchasing, and a large minority of 40% of parents of all ages are likely to consider toys that highlight different races, cultures, identities, and abilities.

Parents also admit to being under the ‘kidfluence’ of their children, which is tied to the impact of marketing on children.

Nearly three in five parents (58%) say their purchase decisions have been influenced by children asking for a toy they first saw advertised online or posted by an influencer on social media. This trend, not surprisingly, is more common among parents of younger, elementary school-aged kids (69%).

For more information on the holiday season’s hottest trends—including toy and game gift ideas for all ages and interests—consult The Toy Association’s shareable infographic and video.

Stay tuned for the ultimate guide to the hottest toys of the gift-giving season in early November, when the Toy of the Year® Award (TOTY®) finalists are revealed across 16 categories of play. Follow #TOTY and visit ToyAwards.org on November 7 for even more must-have toys for all ages.

Founded in 1916, The Toy Association is the business trade association representing all businesses involved in creating and delivering toys and youth entertainment products. The Toy Association advocates for the health and growth of the U.S. toy industry, which has an annual U.S. economic impact of $102.8 billion, with its roughly 900 members driving the annual $41 billion U.S. domestic toy market.