By Gary Symons

TLL Editor in Chief

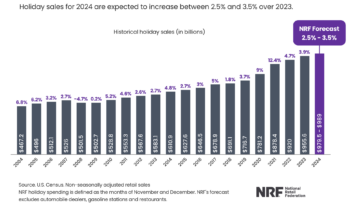

The National Retail Federation predicts holiday spending will grow by 2.5 to 3.5% in 2024, boosting U.S. spending to almost $1 trillion.

The NRF says the increase will equate to spending of between $979.5 billion and $989 billion in total holiday spending in November and December, compared with $955.6 billion during the same time frame last year.

A similar report from Price Waterhouse Cooper (PwC) showed the possibility of an even greater boost north of the border in Canada, with respondents saying they expect to increase their holiday spending by 13%.

“The economy remains fundamentally healthy and continues to maintain its momentum heading into the final months of the year,” NRF President and CEO Matthew Shay said. “The winter holidays are an important tradition to American families, and their capacity to spend will continue to be supported by a strong job market and wage growth.”

“The economy remains fundamentally healthy and continues to maintain its momentum heading into the final months of the year,” NRF President and CEO Matthew Shay said. “The winter holidays are an important tradition to American families, and their capacity to spend will continue to be supported by a strong job market and wage growth.”

The holiday forecast is consistent with NRF’s earlier forecast that annual sales for 2024 will be between 2.5% and 3.5% over 2023.

In Canada, where spending has been dampened over the past two years due to concerns over inflation, consumers plan to spend an average of $1,853 on gifts, travel and entertainment this holiday season, a 13% increase over last year.

That increase in consumer confidence comes as survey data shows Canadians see their economic outlook is brightening as inflation and interest rates decline. PwC says 65% of respondents believe the economy will stabilize or improve over the coming months, up from 48% a year ago.

PwC does caution that the rise in spending intentions doesn’t necessarily mean all consumers plan to buy more. “Shoppers are conscious of recent price increases and recognize they need to spend more to obtain many of the same products and services they regularly purchase,” PwC says. “Indeed, 81% told us they expect to see higher prices for all items this year.”

The forecast data is good news for both the retail and licensing industries, as the holidays typically see a major increase in branded products such as toys and apparel. The toy industry in particular would welcome an increase in consumer spending, as toy sales slumped over the past two years, and only stabilized in the first half of 2024.

“After a difficult year in 2023, when inflation began taking a heavy toll on consumer spending, Circana is pleased to report that toy sales have stabilized in the first half of 2024, in terms of both value and units sold, as average prices hold steady with last year,” said Frédérique Tutt, global toys industry advisor, Circana. “We continue to observe strong momentum with older consumers, especially adult fans and collectors who have re-discovered play and are very engaged with the category.

“As we move through the second half of the year (2024) and prepare for the holiday season, we expect to see more new products being launched that will deliver excitement for children and adults alike. The industry will continue to gain traction in product categories, including building sets, plush, robotic interactive pets and collectibles.”

Who’s News: Miraculous Appoints Global Head of Consumer Products

Earlier this year, Licensing International released a report stating the licensed toy category had suffered the greatest slump in sales of any licensing category in 2023, with a -3.5% decline, and the toys/games market overall falling by -4.5% worldwide. Putting the trend in perspective, the slump in 2022 and 2023 followed rapid growth during the pandemic years from 2020-2022.

This year, however, should mark a return to growth for toys and other categories that typically rise during the winter holidays, such as travel, fashion, toys, entertainment, food and beverage, and restaurants, for example.

The NRF is forecasting growth in retail will be a major driver of this recovery, and in particular a surge in online shopping. Online and other non-store sales, which are included in the total, are expected to increase between 8% and 9% to a total of between $295.1 billion and $297.9 billion, the NRF says. This figure is up from $273.3 billion last year. By comparison, last year non-store sales rose 10.7% over 2022.

“We remain optimistic about the pace of economic activity and growth projected in the second half of the year,” NRF Chief Economist Jack Kleinhenz said. “Household finances are in good shape and an impetus for strong spending heading into the holiday season, though households will spend more cautiously.”

Increased consumer demand during the holiday season is expected to drive the jobs market as well, creating even more consumer confidence. For example, more sales associates are needed to support business operations, so NRF expects retailers will hire between 400,000 and 500,000 seasonal workers this year. This compares with 509,000 seasonal hires last year.

NRF’s holiday forecast is based on economic modeling using various key economic indicators including consumer spending, disposable personal income, employment, wages, inflation and previous monthly retail sales releases. NRF’s calculation excludes automobile dealers, gasoline stations and restaurants to focus on core retail. NRF defines the holiday season as November 1 through December 31.

Memento Sells Out Collectibles for Moto3 Champion David Alonso